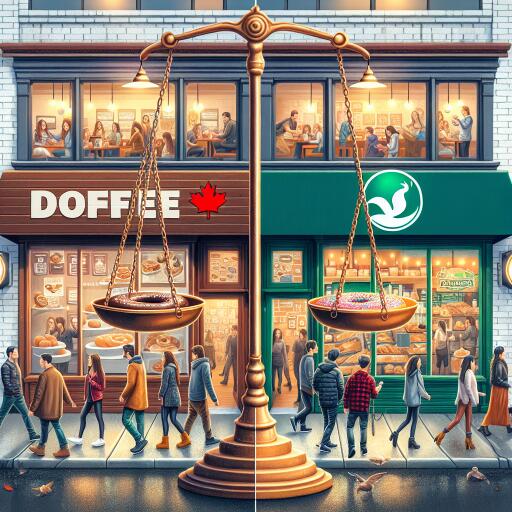

Better Stock to Buy Now: Tim Hortons or Starbucks?

Investing in popular coffee franchises like Starbucks has historically yielded substantial returns for investors. Over the past two decades, a $1,000 investment in Starbucks would have grown to over $4,000. Including dividends, total returns would exceed $5,150, showcasing the robust growth and expansion of this coffee giant.

Despite Starbucks’ global presence, Tim Hortons, operated by Restaurant Brands International (which also manages Burger King and Popeyes), is becoming increasingly popular. This brings up an important question for investors: which stock, Starbucks or Restaurant Brands International (QSR), is the better buy at the moment?

With a market cap of US$86 billion, Starbucks shares are trading 40% below their all-time highs. This presents a potentially attractive entry point for investors into this reputable brand. The pressure on Starbucks’ stock price followed its fiscal second quarter of 2024 earnings, where it reported revenue and adjusted earnings that fell short of analyst expectations. This was mainly due to a decline in same-store sales, particularly in its largest markets, China and the U.S.

However, Starbucks plans to dramatically expand its global footprint by 2030, aiming to operate 55,000 stores worldwide. The company continues to grow its loyalty program and enhance its mobile app, both of which could bolster future sales.

Starbucks’ current dividend yield stands at an appealing 3%, with the company having a history of increasing payouts by an average of 17.5% annually since 2011. The stock’s valuation, at 21 times forward earnings, looks attractive, especially when considering it trades at a 19% discount to consensus price target estimates.

On the other hand, Restaurant Brands International (QSR), with a market cap of $44 billion, has delivered nearly triple the initial investment returns since its IPO in late 2014, when dividends are reinvested. QSR also boasts a forward dividend yield of 3.3%. Despite a general underperformance among restaurant stocks in 2024, QSR reported an 8.1% year-over-year increase in system-wide sales in the first quarter.

QSR’s ambition to grow is evident from its recent move to acquire Carrols Restaurant Group for $1 billion, a move expected to enhance its revenue and earnings immediately. The company is positioned to achieve an 8% growth in system-wide sales through 2028. With QSR stock priced at 20.6 times forward earnings and trading at a 20% discount to consensus estimates, it represents another attractive investment opportunity.

Both Starbucks and QSR are compelling options for investors seeking exposure to established, growth-oriented companies in the beverage sector. In addition to their potential for stock price appreciation, both companies offer attractive dividend yields, making them solid additions to any investment portfolio in 2024.